Puzzled with cryptocurrency Tax calculation? Here is a list of Best crypto tax calculator apps that calculate taxes on your bitcoin trading along with portfolio management. Let’s discuss how to calculate tax on your bitcoin earning?

It doesn’t matter how much crypto assets you hold; at the end of the day, you need to pay your taxes. Crypto investors need to report about every penny they hold in their crypto account to the country’s tax authority.

Calculating taxes for your cryptocurrency assets can be time-consuming and stressful at the same time. The amount of crypto taxation depends on the number of crypto assets you hold, a number of trades, and the number of exchange platforms you have traded on. One needs to calculate each and every trade in detail and record them individually which can be quite cumbersome. Here comes the importance of cryptocurrency tax software.

There is numerous cryptocurrency tax software available in the market which will do your job, calculate your taxes efficiently and file your taxes for you. This software has connections with all the major crypto exchange platforms and will import your transaction data from the exchange markets and help you fill out the forms for your tax liabilities.

Best Cryptocurrency Tax Calculator

Lets, have a look into some of the best cryptocurrency tax calculator apps and software available in the market. Currenctly it supports over 2500 cryptocurrencies and auto syncs your transaction details to manage your tax information.

CoinTracker

Cointracker is one of the best platform that displays your cryptocurrency portfolio and automatically generates your tax calculations on the basis of your portfolio. It allows subscribers to use any of five different available methods for generation of tax form including HIFO (Highest In, First Out), FIFO (First In, First Out), LIFO (Last In, First Out), ACB (Adjusted Cost Base) and share pooling. Users are required to connect their wallets for the purpose of tax calculation and Cointracker account supports over 300+ crypto exchanges so that users can sync their portfolio. Cointracker is integrated with TurboTax and users accountant’s software and they offer complete support in US, UK, Canada, Australia, and partial support for other countries. Cointracker mobile app is also available for iOS and Android platforms. Click and join through the link below to grab 10% discount on your first tax plan.

Koinly

Koinly is free to use and will help you calculate your crypto taxes in no time. It only charges when you need to file a report. It supports more than 100 countries. After sign up, there is an option. You can either choose to generate profits every time you trade and if you choose no, then Koinly will simply track your portfolio. You have to link all your exchange platforms and wallets to Koinly. You can do this manually or through an API program.

Koinly currently supports 33 exchanges and 6 blockchains such as BCH, LTC, BTC, etc. Koinly reviews all your transactions, airdrops, forks, lost or gained coins. Koinly has tools that track your trading habits, costs, and mining expenses as well.

There are three plans available in Koinly:

- Hodler plan charges $79 per year. It covers about 300 transactions a year.

- Trader plan costs about $179 a year and covers 3000 transactions.

- Oracle plan will cost $399 and covers 10000 transactions with added features and import assistance.

Cointracking

Cointracking is a portfolio tracker and is especially helpful for active traders to track their daily transactions. The timeline tools give insights into your per day trading balance, a number of trades per month, and per exchange and also purchase price of cryptocurrencies.

If you are holding a coin for more than a year, Cointracking will help you evade your taxes by selling it tax-free in the market. US citizens can create an FBAR report for assets worth $10,000 in their foreign financial accounts. Cointracking supports the majority of the wallets and trade exchanges.

Cointracking supports the FIFO, LIFO, HIFO, and LOFO methods of which the FIFO is most commonly used. You can pay your subscriptions through BTC coins and there is also a lifetime license option is available in the software. There is a free plan that covers 200 tx and the pro covers 3,500 tx.

Crypto Tax Degens

Crypto Tax Degens is a cryptocurrency-focused community that provides valuable insights on crypto tax matters. Our aim is to democratise top-notch crypto tax guidance, making it accessible to all, along with the unique opportunity to engage with globally renowned tax experts. By joining our community, you’ll gain exclusive access to expert advice on navigating topics such as NFT tax, crypto tax benefits, estate planning, compliance, DeFi transaction taxation, and many other relevant subjects.

CryptoTaxCalculator.io

CryptoTaxCalcultor is another automated platform to get all information depending upon your capital gains in all your cryptocurrency investment. It automatically categorize user’s transaction history and supports Pools, Airdrops, Mining rewards, ICOs, OTC, lost or stolen funds crypto payments. Though it is linked with exchanges but users can easily upload their data manually through API or CSV, review their transactions and easily generate their crypto taxes. Subscription plans start with $99/year for Starter to $1899/year for the Accountant plan. They allow users to cancel a subscription at any time with a 30-day money-back guarantee. At present, it supports 60+ exchanges.

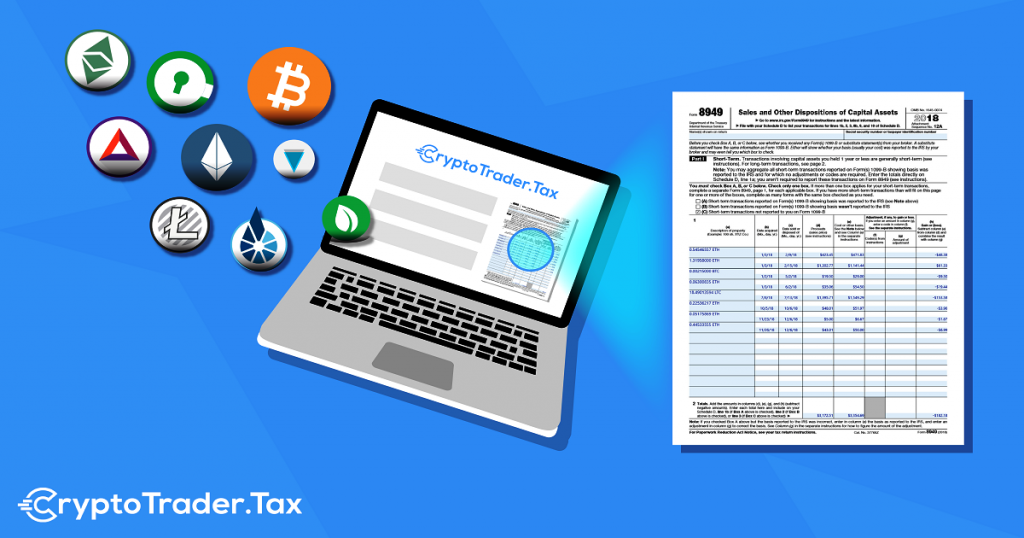

CoinLedger( formally CryptoTrader.Tax)

CoinLedger is the easiest and most intuitive crypto tax calculating and NFT tax software. It serves as a “one-stop shop” to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining, staking, lending, or simply buying or trading, CoinLedger will automate your tax reporting. Signing up and testing out the platform is completely free. You can import all of your data and make sure everything looks good before ever having to pay.

This is much different than any of the other tax platforms out there who make you pay upfront. Once all of your data is in and everything looks good, you can pay for and download your tax report. CoinLedger has also partnered up with companies like Intuit TurboTax so that you can plug your reports into this filing software.

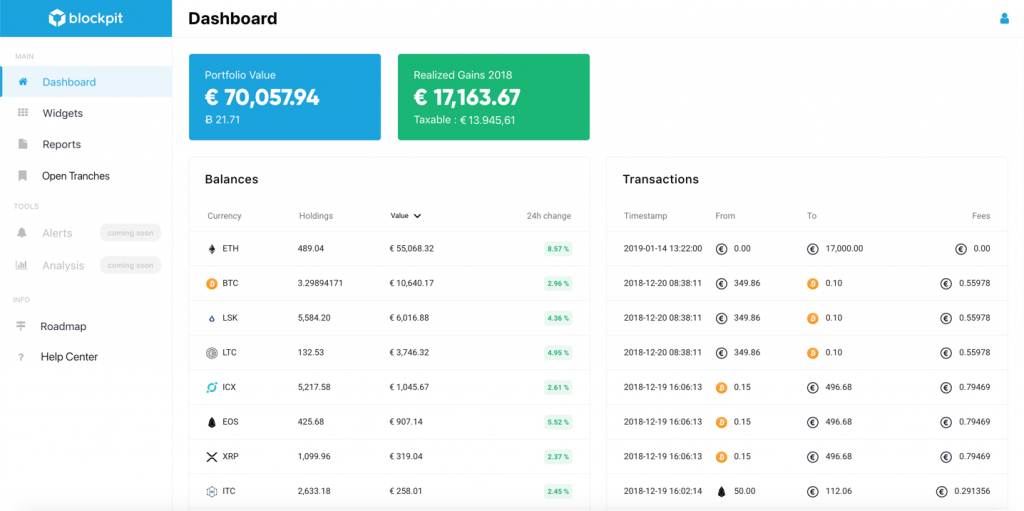

Blockpit

Blockpit manages all your trade details, wallets, and exchange transactions under a single platform. It also manages your income generated through mining, ICO, and airdrops. You can view all your real-time transactions and download your complete tax report on your mobile app. Blockpit supports the majority of the cryptocurrencies in the market.

Bittax

Bittax will track your crypto transactions, import exchange data, wallet address, and calculate your taxes while keeping all your private information intact. Bittax uses a tax planning algorithm mechanism and helps you organize and manage all your tax liabilities and profits keeping in mind the standard protocols of IRS.